[ad_1]

Seller’s permits are state-specific. The online business landscape is a maze because states in the U.S. have unique licensure laws. Plus, permits intended for the same sales tax purpose may have different names and requirements in various states.

To help you understand your online business license needs, we’ll share essential business permit requirements across the U.S., how to access them and when exemptions apply.

You’ll also get an overview of export licensing, types of business permits, how to apply for licenses and how long it takes to get these permits. If you operate an online business from home, you’ll learn how to get a home-based business permit.

Due to the case-by-case and state-specific nature of business licenses, the ideas here are guideposts to help you decide if you need a seller’s permit to sell online. It’s best practice to consult local and state licensing authorities for personalized guidance.

What is a business license?

A business license is a legal permit issued by governments authorizing individuals or entities to operate a business within a specific jurisdiction. It ensures compliance with local regulations and allows for the collection of taxes.

A business license is crucial for an entrepreneur, as it legitimizes your operations and helps you maintain a regulated business environment. Failure to secure the necessary permits for your business may attract fines or other penalties.

Do you need a business license to sell online?

The need for a business license to sell online varies by jurisdiction. However, many regions mandate online sellers to get a license. Business license laws may change without notice — consult your local authority to ensure compliance with these laws.

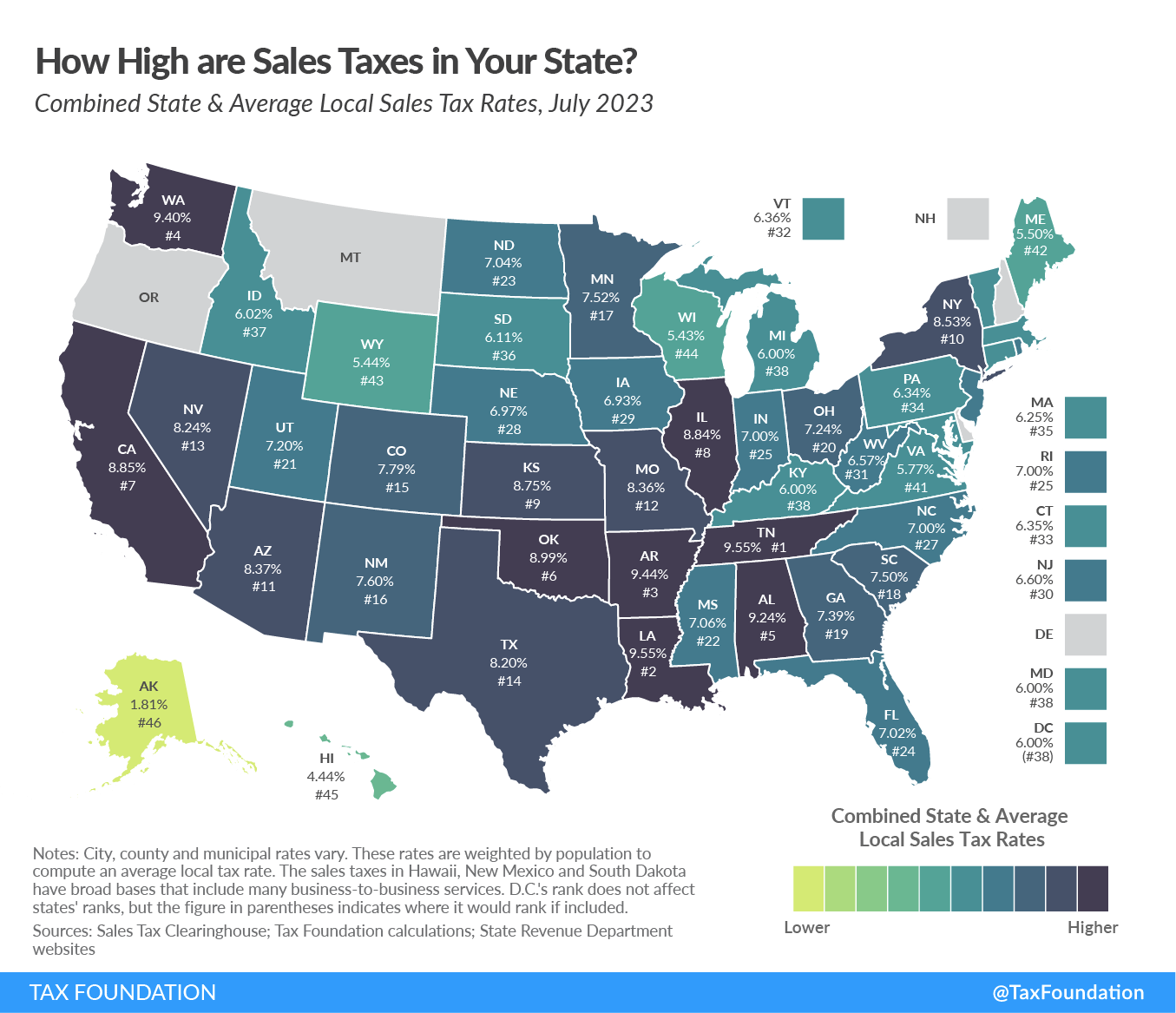

Apart from your business registration certificate, you don’t need a license to sell online in states like New Hampshire, Delaware, Montana and Oregon. These states don’t require sellers to remit a general sales tax.

On the other hand, South Dakota, New York and California require sales taxes from online businesses.

General sales taxes are taxes you add to the price of your products or services. You must collect and remit this extra amount to the government, usually at the state and local levels.

Note that each state has nuanced legal interpretations of how they issue licenses to eCommerce businesses.

Some states don’t have a generally applicable business license law for online sellers.

For instance, Alaska prioritizes your business activity over location when issuing business licenses, meaning the state focuses on the nature of your business, including your business structure and the type of products you sell.

For example, you may need a specific license to sell homemade health products regardless of whether you sell online in rural Alaska or from a physical store in downtown Anchorage.

Meanwhile, the midwestern state of South Dakota starts collecting sales tax if your online business makes more than $100,000 annually.

Research local and national regulations to determine if a business license is required in your location, as the requirements can differ.

In addition, some digital platforms may have internal policies regarding licensing to protect your legal rights as a seller. So, you must adhere to these policies if you want to sell on these platforms.

Who is exempt from needing a business license?

Business registration is not mandatory in the U.S. if you’re a sole proprietor operating under your legal name. However, you may need other state or federal licenses and permits to run your business, depending on its legal structure, among other factors mentioned earlier. In some cases, you may be eligible for a license exemption based on your line of business.

States across the U.S. — even states that collect taxes from online sellers — have business license exemptions. For example, South Dakota exempts businesses that earn $100,000 or less from paying sales tax.

Some business license exceptions may have limitations. For example, Alaska has no general sales tax, but local, municipal and county governments may request sales taxes from or grant exemptions to businesses within their jurisdiction.

Check with local tax authorities to know if your business qualifies for an exemption. This ensures you’re taking advantage of any available exemptions, helping you save money.

Do you need a business license to sell products internationally?

You may need a license to sell products internationally. The Bureau of Industry and Security (BIS) oversees the United States Export Administration Regulations (EAR) and outlines export control regulations, which guide the export of certain products.

Online sellers must comply with these regulations, which may involve obtaining licenses and adhering to export restrictions based on the destination country.

EAR doesn’t cover all U.S. goods, services and technologies. Specific government agencies handle specialized exports. For example, the Department of State oversees defense items. Find other controlling agencies on the BIS website.

Consult the EAR or relevant export authorities to verify if your product qualifies for an exemption or if you need an export license.

Types of licenses and permits for online sellers

Let’s explore the types of permits you need to sell online, hire employees and manage your business.

Online vs. brick-and-mortar business license

States like Alaska do not distinguish between online stores and physical businesses. However, you will need a local license for controlled goods or regulated professional services in these states. Selling online or offline won’t be a consideration for issuing the license.

Apart from securing state and federal business registration and licenses, you may need other specialized licenses to sell items online. Ask your local tax authority if your online business needs any special license to sell products or services.

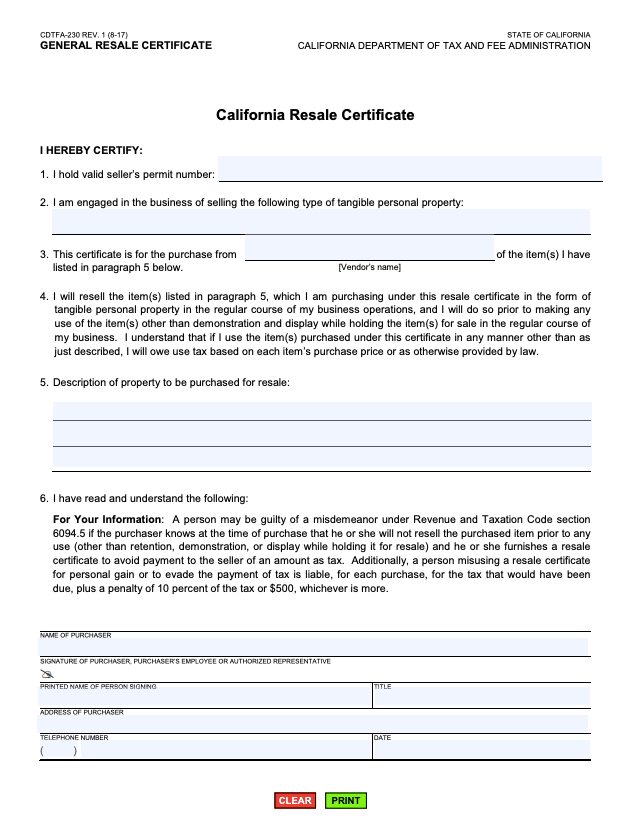

Seller’s permit vs. sales tax permit

Seller’s permits and sales tax permits are often used interchangeably, but their meanings vary by state. However, both permits authorize businesses to collect and remit sales tax to the state.

Here’s an overview of each permit:

Sales tax permit:

- A state’s authorization to collect sales tax on eligible sales.

- Businesses that sell physical goods or certain digital products need a sales tax permit.

- The permit lets you levy sales tax on transactions and remit it to the state’s taxing authority.

Seller’s permit:

- Seller’s permits may cover more than sales tax in some states.

- It may authorize sellers to collect and remit other taxes, such as use tax on goods bought for in-state use without sales tax at purchase.

- Seller’s permits may serve regulatory purposes for governments, like coordinating tax collection with resale certificates.

Some states use “sales tax permit,” and others use “seller’s permit” or similar terms. So, terminology and requirements differ. Additionally, some states mandate permits at the state level and others at the municipal level.

General business licenses

State and federal governments issue general business licenses to entities, authorizing them to operate within a specified jurisdiction. Typically, anyone engaging in business activities, such as selling physical goods or digital services, needs a license.

Most states issue general business licenses, but some may have unique conditions. Requirements and fees vary by state.

For example, California has stringent regulations and specific licensing requirements for food, alcohol, healthcare or professional service businesses. New York requires city-specific permits and industry licenses like health permits for restaurants, but home-based food businesses may qualify for exemption.

Employer permits and licenses

Get a federal Employer Identification Number (EIN) from the Internal Revenue Authority (IRS) to help you separate business from personal finances — this tax ID is free. Moreover, you’ll need an EIN to transition from sole proprietor to employer, open a business bank account and manage your business on marketplaces like Amazon.

In addition, you’ll need to register for employer withholding tax in your state or municipality if you have employees. Employers deduct employer withholding tax from their employees’ wages on behalf of the government for income taxes, Social Security and Medicare obligations.

Other employer permits may apply in your county or state. Consult with local tax authorities for guidance.

Professional and occupational permits

States like California maintain an exhaustive list of occupational licenses and permits that might impact your business.

You may need occupational licensing if you do business in any of these regulated fields:

- Controlled goods like tobacco, cryptocurrencies, alcohol and gambling.

- Professional services like health, real estate, architecture, law and accounting.

- Trades such as transportation, cosmetics, construction and food preparation.

Search your state’s or city’s website for occupational licenses related to your small business administration to understand your licensing, certification and permit needs.

How to apply for an online business license

States may require that you get an online business license — seller’s permit, sales tax permit or a general sales tax license.

Although states have nuanced interpretations of how licensing works, it’s intended for businesses to collect and remit taxes to state or local governments on items sold remotely.

Seller’s permits take roots from a 2018 U.S. Supreme Court judgment of South Dakota v. Wayfair. The court decided that states could ask vendors to gather and remit sales taxes even in jurisdictions where they’re not physically present.

Following this landmark ruling, states rolled out their guidelines for online sellers. However, small business owners may qualify for an exemption.

Do you need a sales tax permit?

Whether you need a sales tax permit depends on your business activities and the state or municipality where you operate. Typically, it applies to tangible goods, such as electronics, clothing and furniture. However, some states also tax services and digital products.

Your local tax authority can advise you on the types of items subject to sales tax in your area.

How to get a seller’s permit or sales tax permit

An online business license helps you legitimize your online venture. Follow these steps to obtain your permit:

- Research state regulations: Business licenses vary by state, so get acquainted with the specific requirements in your location. Visit your state’s Department of Revenue website for accurate information.

- Determine your business structure: Determine if your business is a sole proprietorship, limited liability company (LLC) or corporation, and register your business name if required. Your business structure influences the license you need. Prepare the necessary details about your business, including your Employer Identification Number (EIN) and product or service information.

- Apply for the license: Most states offer online applications. Fill out the required forms carefully and double-check for accuracy. Scan and attach requested documents, such as identification, proof of address and business plans. Be ready to provide details about your online sales activities, location and ownership.

- Submit your application: Carefully review your application for errors. Once satisfied, follow the submission instructions provided. Some states may require a fee, while others, like Texas, offer free permits.

Licensing authorities might contact you for additional information while reviewing your application. Once you’ve obtained your online business license, display it prominently on your website.

Avoid license termination by setting up reminders for license renewal dates. Stay compliant to avoid legal issues.

The steps highlighted here are an overview — your state or municipal authorities may require additional processes.

Do you need a home occupation permit?

You need a home occupation or home-based business permit to conduct business activities from a residential property. This ensures compliance with local zoning regulations. If your home address doubles as your business address, secure this license.

Some states, like California, may require additional business licenses for your home-based business. For instance, you’ll need a business license from the tax collector’s office after getting a home occupation permit in California.

Here’s how to obtain a home occupation permit:

- Check local regulations: Contact your local zoning authority — via website, email or phone — to ensure your business is eligible for a home occupation permit.

- Apply for the permit: Provide accurate business details in your application and pay any requested fees.

- Submit documents: Submit required documents, including a site plan or business plan, depending on local regulations.

Authorities will review your application and may inspect your property to assess neighborhood impacts. Once the review is complete, you’ll get an approval or rejection.

Regulations can vary significantly depending on your local jurisdiction. Always check with your local government or zoning office to determine specific requirements and whether your particular type of home-based business needs a permit.

Additionally, some jurisdictions may have exemptions for businesses that meet certain criteria, such as having minimal impact on the neighborhood or not generating excessive traffic.

How long will it take to get your business license?

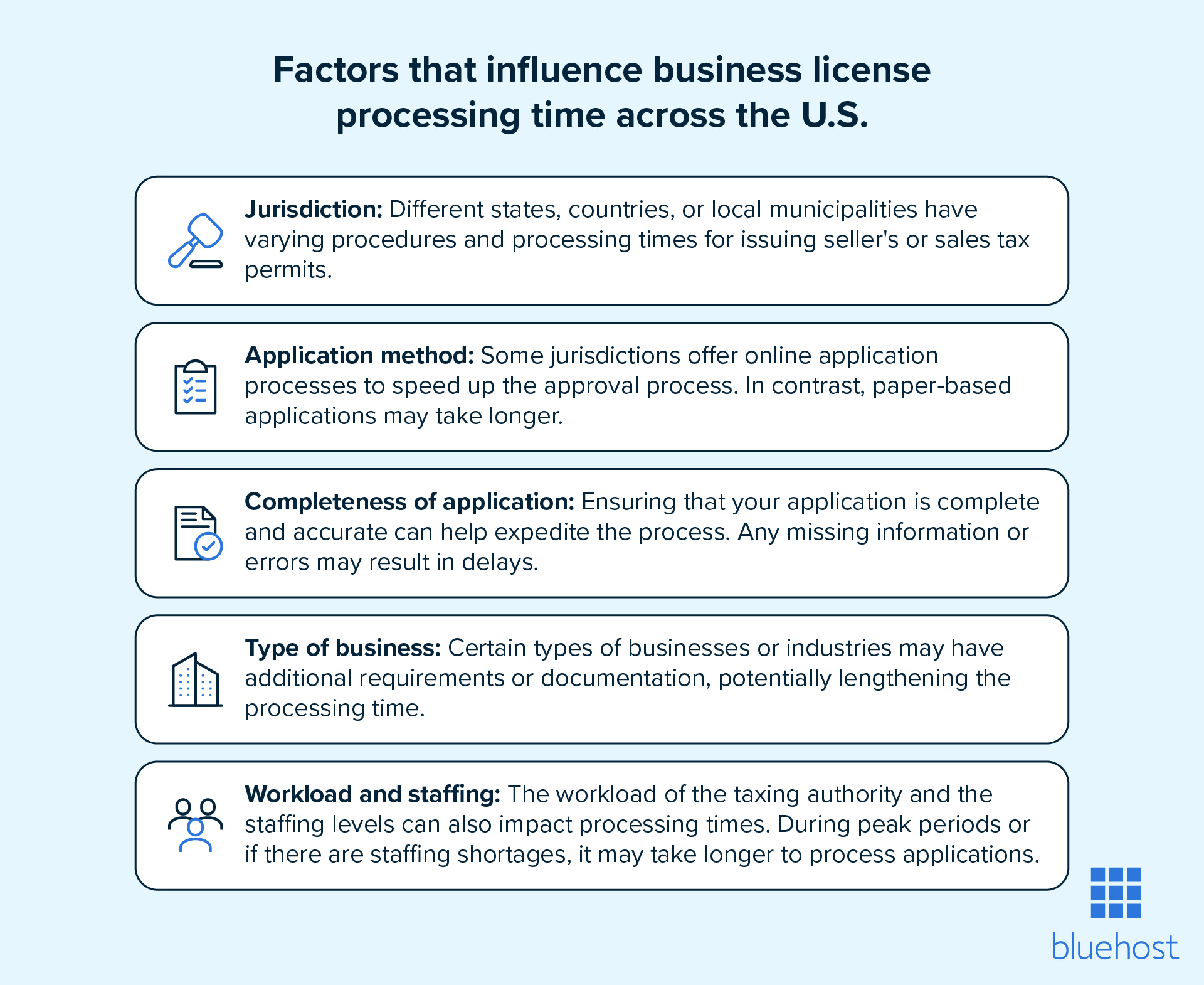

The processing time for seller’s or sales tax permits varies by location (state or municipality) and application method. Jurisdictional procedures, application completeness, business type and workload also influence licensing time.

Online applications can expedite the process but permits typically take a few weeks. In Illinois, for instance, online processing can be as quick as two business days. Confirm specific processing times with local taxing authorities.

Final thoughts: Do you need a business license to sell online?

The online business world is like a puzzle, with each U.S. state having unique rules. In this guide, we’ve covered the key points from general requirements to export licenses and permits for home-based businesses.

However, things can vary depending on your location and business activities, so seek expert guidance from appropriate authorities.

The eCommerce platform you choose can reduce or increase your business’s tax compliance level. For instance, online store platforms with payment compliance features can help you minimize costs and meet multi-region sales tax demands.

Bluehost offers affordable WooCommerce hosting to help you run an online store with ease. And with WooPay, you can manage payments and automate tax compliance in one place.

Select the Bluehost online store hosting plan that best meets your needs.

The post Do You Need a Seller’s Permit to Sell Online? appeared first on Bluehost Blog.

[ad_2]

Article link